Find Out 32+ List Of Accrual Accounting Is Used Because They Forgot to Share You.

Accrual Accounting Is Used Because | It holds specific meanings in accounting. Using the transactions above, the accrual basis of accounting will result in the december income statement reporting revenues of $10,000 and for financial statements prepared in accordance with generally accepted accounting principles, the accrual basis of accounting is required because of. It provides a better indication of ability to generate cash flows than the cash basis. Because the accrual method conforms to the generally accepted accounting principles (gaap), it must be used by all companies with more than your books could show a large amount of revenue when your bank account is completely empty. Here, in this article we have compiled the difference between cash accounting and accrual accounting, take.

Managerial accounting is also called as management accounting or cost accounting. Sale transaction and account receivable from the seller's viewpoint. Then, at the end of the billing. Accrual accounting also conforms to gaap and is required by all companies that make more than $25 million annually. For example, you would record revenue when a project is complete, rather than when you get paid.

…is an accounting method that records revenues and expenses when they are incurred, regardless of when cash is exchanged. As a small business owner, you're likely already using one accounting method or the other. From a tax standpoint, it is sometimes advantageous for a new business to use the cash. It holds specific meanings in accounting. Then, at the end of the billing. A clothing store, for example, sells 100. The accrual basis of accounting is advocated under both generally accepted accounting principles (gaap) and international financial reporting the accrual basis requires the use of estimates in certain areas. Cash basis or accrual basis. While $25 million is a lofty goal for small businesses, choosing the accrual method means that you accrual accounting is also required by some banks regardless of business income. Accrual accounting gives a better indication of business performance because it shows when income and expenses occurred. Accrual accounting measures a company's performance and position by recognizing economic events regardless of when cash transactions occur, whereas cash accounting only records transaction when. Accrual accounting is used to record the revenues and expenses that were generated during a cashless transaction. Accounts payable questions & answers for aieee,bank exams,cat, analyst,bank clerk,bank po :

A clothing store, for example, sells 100. Accrual accounting is a method used to record transactions when they happen instead of when money exchanges hands. The term accrual refers to any individual entry recording revenue or expense in the absence of a cash transaction. As a small business owner, you're likely already using one accounting method or the other. It holds specific meanings in accounting.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/close-up-of-pen-with-paper-currency-on-book-930239198-5c3b7a3a46e0fb000148b9d1.jpg)

Accrual accounting also conforms to gaap and is required by all companies that make more than $25 million annually. For example, you would record revenue when a project is complete, rather than when you get paid. …is an accounting method that records revenues and expenses when they are incurred, regardless of when cash is exchanged. Most businesses typically use one of two basic accounting methods in their bookkeeping systems: An example of the cash versus the accrual basis of an example of the difference between the accrual and the cash bases of accounting is presented below. Accrual accounting is one of two accounting methods; Because they use the accrual method of accounting, scott and lisa count the $750 income in december 2016, the date they earned the money by finishing the job. Its cost is allocated over its useful life and. It provides a better indication of ability to generate cash flows than the cash basis. Accrual accounting is used because. How to choose the right option for your business. Accrual accounting will provide a better indication of ability to generate cash flow than the cash basis. Adjustments for earned revenues or incurred expenses but are not yet the purpose of accrual accounting is to match revenues and expenses to the time periods during which the consumer uses the electricity and the meter counts the reading.

Accrual accounting gives a better indication of business performance because it shows when income and expenses occurred. In addition, most individuals use the cash basis of accounting in determining their taxable income. From a tax standpoint, it is sometimes advantageous for a new business to use the cash. This income must be reported in their 2016 tax return even though they don't receive the money until 2017. The term accrual refers to any individual entry recording revenue or expense in the absence of a cash transaction.

Accrual accounting will provide a better indication of ability to generate cash flow than the cash basis. By using accrual accounting for reporting sales, the firm has a strong indicator of where it stands in the market. It recognizes revenues when cash is received and expenses when cash is paid. Cash basis or accrual basis. Here we discuss the top 10 most common examples of accrual accounting along with its journal entries. As it relates to the latter, accrual accounting is complex because it asks for judgment from the business executives themselves as well as their auditors, and, of course, from the research analysts. Transactions appearing only in accrual accounting. …is an accounting method that records revenues and expenses when they are incurred, regardless of when cash is exchanged. Accounts payable questions & answers for aieee,bank exams,cat, analyst,bank clerk,bank po : While $25 million is a lofty goal for small businesses, choosing the accrual method means that you accrual accounting is also required by some banks regardless of business income. Accrual accounting is a necessary business practice for saas and subscription models, along with mrr and revenue recognition. The other is cash accounting. The cash method is used by many sole proprietors and businesses with no inventory.

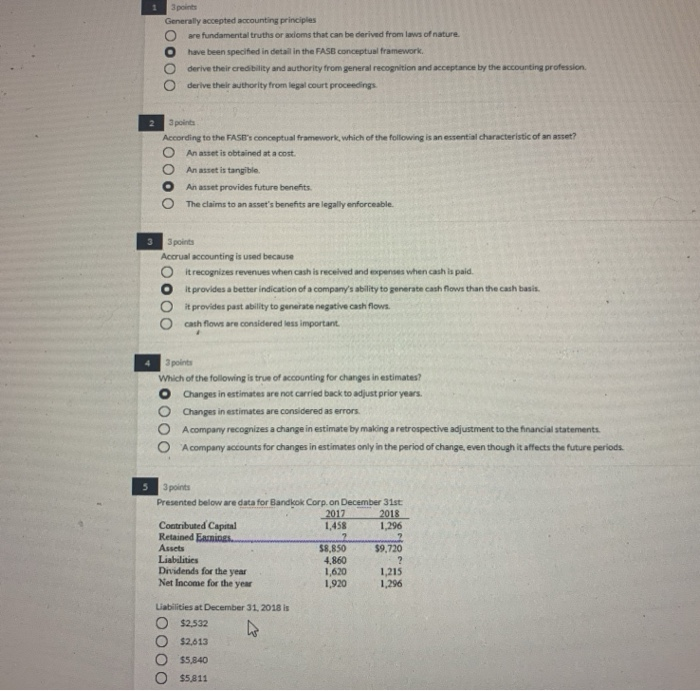

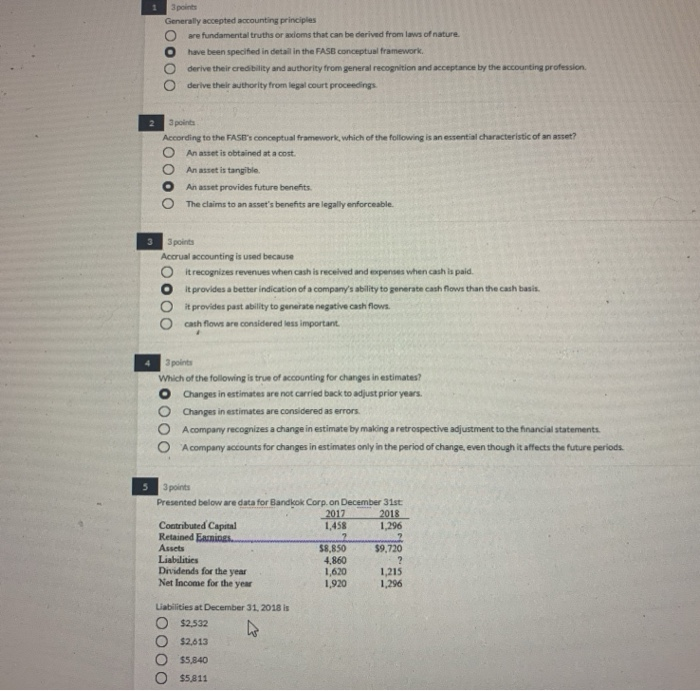

Accrual Accounting Is Used Because: This table shows how 10 different transactions.